Behavioral Analysis

The science of understanding, explaining, and predicting human behavior.

Behavioral Analysis & Investments

Behavioral analysis in investments examines how psychology influences decisions that shape investment results. When incorporating behavioral analysis into investments, it is beneficial to divide the analysis into two categories: individual and organizational.

Individual analysis assesses rationality, cognitive biases, self-awareness, and cognitive control. Organizational analysis evaluates the social and cultural dynamics that influence investment outcomes.

Human behavior plays a significant role in driving value in private markets, as investment success is closely tied to factors like relationships, skill, and experience. Therefore, when assessing private fund managers, behavioral analysis is especially valuable.

“The ideal organizational environment encourages everyone to observe, collect data, and speak up.”

Richard Thaler

Nobel laureate in Economics, Misbehaving

“A compelling narrative fosters an illusion of inevitability.”

Daniel Kahneman

Nobel laureate in Economics, Thinking, Fast and Slow

“In a decade of applying behavioral analysis to private markets investing, we have observed two clear patterns:

1. Firms that foster open cultures consistently demonstrate increased levels of engagement, creativity and communication, leading to better performance.

2. Effectively addressing cognitive biases throughout investment analysis can dispel the illusion of inevitability that many managers skillfully create.”

Trenton Smith

Managing Partner, Ridgepine Capital Partners

The Challenge of Applying Behavioral Analysis

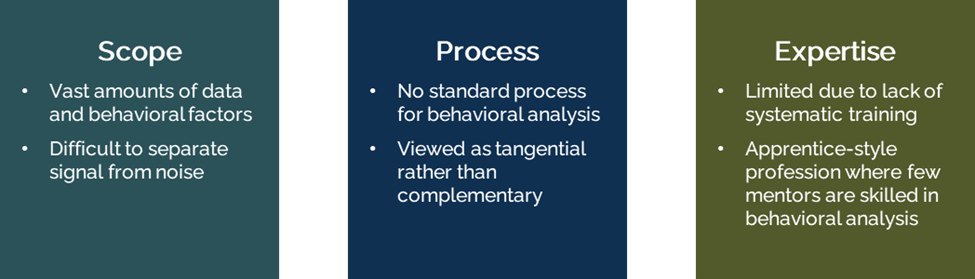

Most underwriting processes focus on the quantitative aspects of investment opportunities, neglecting insights from behavioral economics and behavioral finance. We believe this oversight stems from three main factors: scope, process, and expertise.

The Ridgepine Solution

Investors who integrate robust quantitative work with expert behavioral analysis gain a significant advantage.

Ridgepine has the expertise and a proprietary time-tested process to deliver insightful behavioral analysis of private market investments. We have extensive experience seamlessly combining quantitative analysis with our unique behavioral due diligence process in multi-billion-dollar private market portfolios.

Our proprietary behavioral due diligence process, rooted in evolutionary psychology, enables us to identify and evaluate the key behavioral traits of fund managers who consistently outperform.